2025 Soft Tissue Fixation Systems Manufacturing Industry Report: Market Dynamics, Technological Innovations, and Strategic Forecasts Through 2030

- Executive Summary and Market Overview

- Key Technology Trends in Soft Tissue Fixation Systems

- Competitive Landscape and Leading Manufacturers

- Market Growth Forecasts and Revenue Projections (2025–2030)

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Opportunities

- Challenges, Risks, and Strategic Opportunities in Soft Tissue Fixation Systems Manufacturing

- Sources & References

Executive Summary and Market Overview

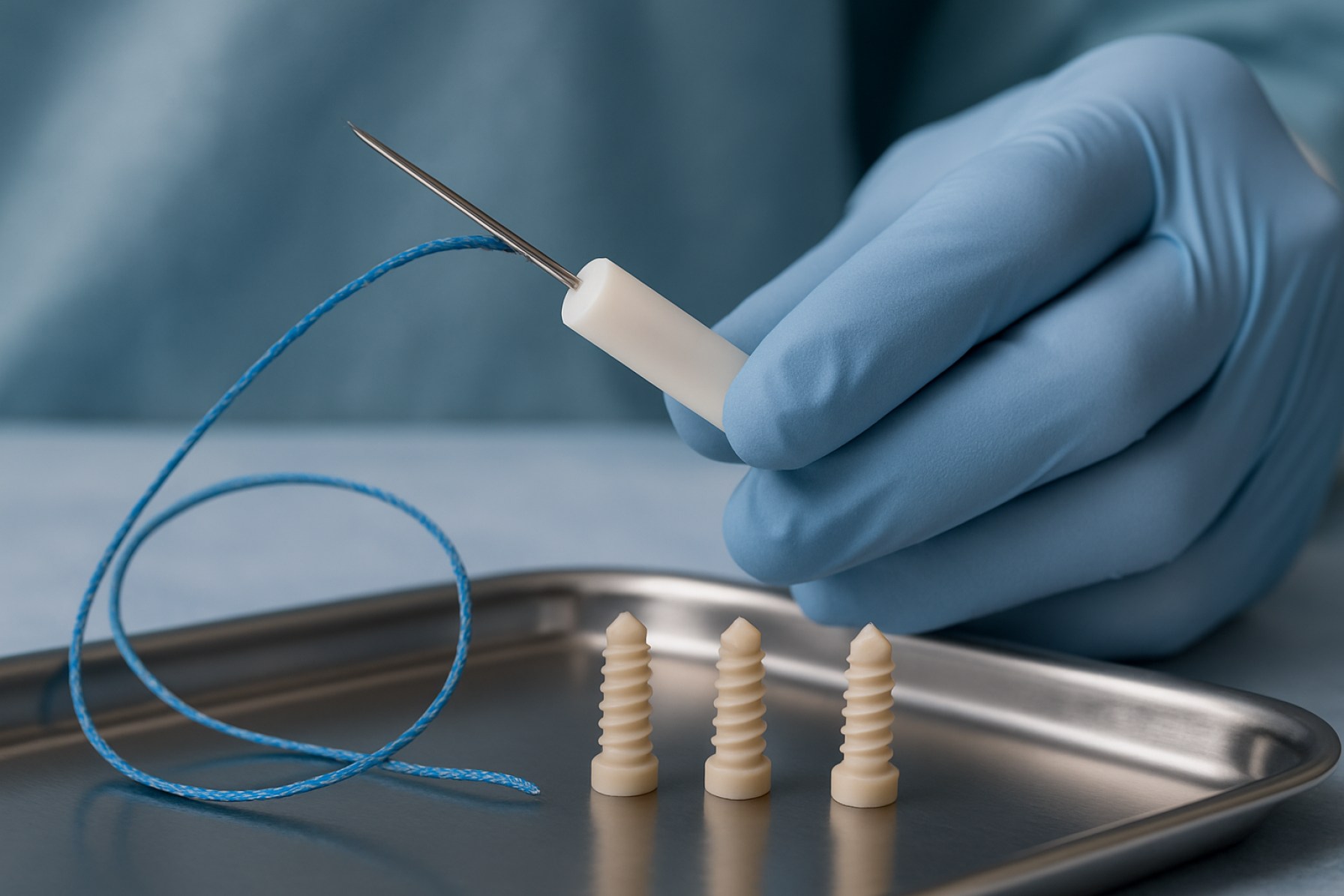

The global soft tissue fixation systems manufacturing market is poised for robust growth in 2025, driven by increasing incidences of sports injuries, rising geriatric populations, and advancements in minimally invasive surgical techniques. Soft tissue fixation systems are critical medical devices used to reattach or stabilize soft tissues such as ligaments, tendons, and muscles to bone, particularly in orthopedic, sports medicine, and trauma procedures. The market encompasses a range of products, including suture anchors, interference screws, cortical buttons, and other fixation devices, manufactured using advanced biomaterials and precision engineering.

In 2025, the market is expected to benefit from a surge in elective surgeries as healthcare systems recover from pandemic-related disruptions. According to Fortune Business Insights, the global soft tissue fixation market was valued at approximately USD 2.1 billion in 2023 and is projected to grow at a CAGR of 6.5% through 2028, with manufacturing innovation playing a pivotal role in this expansion. Key manufacturers are investing in automation, additive manufacturing (3D printing), and biocompatible materials to enhance product performance and meet stringent regulatory standards.

North America remains the largest market, attributed to high healthcare expenditure, a well-established sports medicine infrastructure, and the presence of leading manufacturers such as DePuy Synthes and Smith+Nephew. However, Asia-Pacific is emerging as the fastest-growing region, fueled by expanding healthcare access, rising awareness of sports injuries, and increased investments in local manufacturing capabilities. The competitive landscape is characterized by both multinational corporations and specialized regional players, fostering innovation and price competition.

- Key Trends: Adoption of bioabsorbable and hybrid fixation materials, integration of digital manufacturing technologies, and a shift toward patient-specific implants.

- Challenges: Stringent regulatory requirements, pricing pressures, and the need for continuous R&D to address evolving clinical needs.

- Opportunities: Expansion into emerging markets, development of next-generation fixation systems, and strategic partnerships with healthcare providers.

Overall, the soft tissue fixation systems manufacturing sector in 2025 is marked by technological advancement, market expansion, and a focus on improving patient outcomes, positioning it as a dynamic and competitive segment within the broader orthopedic devices industry.

Key Technology Trends in Soft Tissue Fixation Systems

The manufacturing landscape for soft tissue fixation systems in 2025 is characterized by rapid technological advancements, driven by the demand for minimally invasive procedures, improved patient outcomes, and cost efficiency. Key technology trends are shaping the way manufacturers design, produce, and deliver these critical orthopedic and sports medicine devices.

- Advanced Biomaterials: Manufacturers are increasingly adopting next-generation biomaterials, such as bioresorbable polymers and composite materials, to enhance biocompatibility and reduce long-term complications. These materials, including polyether ether ketone (PEEK) and magnesium-based alloys, offer improved strength-to-weight ratios and controlled degradation profiles, supporting natural tissue healing and reducing the need for secondary surgeries. Companies like Smith+Nephew and Arthrex are at the forefront of integrating these materials into their product lines.

- Precision Manufacturing and Additive Technologies: The adoption of additive manufacturing (3D printing) and advanced CNC machining enables the production of highly customized and complex implant geometries. This allows for patient-specific solutions and rapid prototyping, reducing time-to-market and enabling iterative design improvements. Stryker and DePuy Synthes have invested heavily in these technologies to streamline their manufacturing processes and enhance product performance.

- Automation and Digitalization: The integration of Industry 4.0 principles—such as robotics, IoT-enabled equipment, and real-time data analytics—has transformed manufacturing floors. These technologies improve process consistency, traceability, and quality control, while also reducing labor costs and minimizing human error. Medtronic and Zimmer Biomet are leveraging digital twins and predictive maintenance to optimize their production lines.

- Sterilization and Packaging Innovations: As regulatory requirements become more stringent, manufacturers are investing in advanced sterilization techniques (e.g., low-temperature plasma, electron beam) and smart packaging solutions that ensure product integrity and extend shelf life. These innovations are critical for maintaining compliance and supporting global distribution.

Collectively, these technology trends are enabling manufacturers to deliver safer, more effective, and increasingly personalized soft tissue fixation systems, positioning the industry for continued growth and innovation in 2025 and beyond. According to Fortune Business Insights, these advancements are expected to drive market expansion and set new standards for product quality and patient care.

Competitive Landscape and Leading Manufacturers

The competitive landscape of the soft tissue fixation systems manufacturing sector in 2025 is characterized by a mix of established multinational corporations and innovative mid-sized companies, all vying for market share in a rapidly evolving orthopedic and sports medicine market. The sector is driven by technological advancements, increasing procedural volumes, and a growing demand for minimally invasive solutions.

Leading manufacturers such as DePuy Synthes (a Johnson & Johnson company), Smith+Nephew, Arthrex, Inc., Stryker Corporation, and Zimmer Biomet dominate the global market. These companies leverage extensive R&D capabilities, broad product portfolios, and established distribution networks to maintain their leadership positions. For instance, Arthrex is recognized for its innovation in bioabsorbable anchors and suture-based fixation devices, while Smith+Nephew has a strong presence in both sports medicine and trauma fixation systems.

The market is also witnessing the emergence of specialized players such as Medacta Group and CONMED Corporation, which focus on niche applications and novel biomaterials. These companies are gaining traction by introducing differentiated products, such as all-suture anchors and bio-composite materials, that address specific clinical needs and surgeon preferences.

Strategic collaborations, mergers, and acquisitions continue to shape the competitive dynamics. For example, Stryker’s acquisition of OrthoSpace expanded its soft tissue repair portfolio, while Zimmer Biomet has invested in digital surgery platforms to complement its fixation systems. Such moves are aimed at broadening product offerings and enhancing value-added services for healthcare providers.

- Product innovation remains a key differentiator, with companies investing in next-generation fixation devices that offer improved biomechanical strength, faster healing, and reduced complication rates.

- Regulatory compliance and quality assurance are critical, as manufacturers must adhere to stringent standards set by agencies such as the FDA and EMA.

- Geographic expansion, particularly in Asia-Pacific and Latin America, is a priority for leading players seeking to tap into high-growth markets.

Overall, the competitive landscape in 2025 is marked by consolidation among top-tier manufacturers, a steady influx of innovative entrants, and a relentless focus on clinical outcomes and patient safety.

Market Growth Forecasts and Revenue Projections (2025–2030)

The global soft tissue fixation systems manufacturing market is poised for robust growth between 2025 and 2030, driven by rising incidences of sports injuries, an aging population, and technological advancements in biomaterials and minimally invasive procedures. According to projections by Fortune Business Insights, the broader soft tissue repair market is expected to reach approximately USD 16.5 billion by 2027, with fixation systems constituting a significant share of this value. For the manufacturing segment specifically, analysts anticipate a compound annual growth rate (CAGR) of 6.5% to 7.2% from 2025 through 2030, outpacing the overall orthopedic devices sector.

Revenue projections for 2025 estimate the global soft tissue fixation systems manufacturing market at around USD 4.2 billion, with North America and Europe accounting for over 60% of total revenues due to high procedure volumes and advanced healthcare infrastructure. By 2030, the market is forecasted to surpass USD 6.1 billion, fueled by increased adoption in Asia-Pacific and Latin America, where healthcare investments and sports medicine awareness are rising rapidly (MarketsandMarkets).

Key growth drivers include:

- Surging demand for arthroscopic and minimally invasive surgeries, which require advanced fixation devices.

- Continuous innovation in bioabsorbable and hybrid fixation materials, expanding the product portfolio for manufacturers.

- Strategic partnerships and acquisitions among leading manufacturers such as DePuy Synthes, Smith+Nephew, and Arthrex, which are consolidating market share and accelerating product development cycles.

Emerging markets are expected to register the highest CAGR, with China and India leading regional expansion due to increasing healthcare expenditure and a growing base of orthopedic surgeons. However, pricing pressures, regulatory hurdles, and reimbursement challenges may temper growth in certain geographies (Grand View Research).

Overall, the 2025–2030 period is set to witness dynamic expansion in soft tissue fixation systems manufacturing, with revenue growth underpinned by innovation, demographic trends, and global market penetration.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global soft tissue fixation systems manufacturing market demonstrates distinct regional dynamics, shaped by healthcare infrastructure, regulatory environments, and the prevalence of sports injuries and orthopedic conditions. In 2025, North America continues to lead the market, driven by advanced healthcare systems, high adoption of minimally invasive procedures, and robust investments in research and development. The United States, in particular, benefits from a strong presence of key manufacturers and a high volume of orthopedic surgeries, with the American Academy of Orthopaedic Surgeons reporting over 600,000 knee replacements annually, many involving soft tissue fixation devices (American Academy of Orthopaedic Surgeons).

Europe follows closely, with significant contributions from Germany, France, and the United Kingdom. The region’s growth is propelled by an aging population, increasing sports participation, and supportive reimbursement policies. The European Union’s Medical Device Regulation (MDR) has also prompted manufacturers to enhance product quality and safety, fostering innovation and market expansion (European Commission). Additionally, collaborations between academic institutions and industry players in Europe are accelerating the development of next-generation fixation systems.

The Asia-Pacific region is experiencing the fastest growth, attributed to rising healthcare expenditures, expanding medical tourism, and increasing awareness of advanced orthopedic treatments. Countries such as China, India, and Japan are witnessing a surge in sports injuries and trauma cases, fueling demand for soft tissue fixation systems. Local manufacturers are increasingly entering the market, supported by government initiatives to modernize healthcare infrastructure and encourage domestic medical device production (India Brand Equity Foundation). Japan’s established orthopedic sector and China’s rapidly growing market size are particularly noteworthy, with both countries investing in technological advancements and regulatory harmonization.

The Rest of the World, encompassing Latin America, the Middle East, and Africa, presents emerging opportunities, albeit at a slower pace. Market growth in these regions is hindered by limited access to advanced healthcare and lower per capita healthcare spending. However, increasing investments in healthcare infrastructure and the gradual adoption of modern surgical techniques are expected to drive incremental growth. Brazil and South Africa are identified as key markets within this segment, with local governments prioritizing improvements in orthopedic care (World Health Organization).

Overall, regional disparities in market maturity, regulatory frameworks, and healthcare access will continue to shape the competitive landscape of soft tissue fixation systems manufacturing through 2025.

Future Outlook: Emerging Applications and Investment Opportunities

The future outlook for soft tissue fixation systems manufacturing in 2025 is shaped by a convergence of technological innovation, expanding clinical applications, and robust investment activity. As the global burden of musculoskeletal disorders and sports injuries continues to rise, manufacturers are increasingly focusing on next-generation fixation devices that offer improved biocompatibility, faster healing, and minimally invasive deployment. Notably, the integration of bioresorbable materials and advanced polymers is expected to drive product differentiation and open new therapeutic avenues, particularly in orthopedics and sports medicine.

Emerging applications are broadening the addressable market for soft tissue fixation systems. Beyond traditional uses in anterior cruciate ligament (ACL) reconstruction and rotator cuff repair, there is growing adoption in foot and ankle, dental, and even reconstructive surgeries. The development of patient-specific implants, enabled by 3D printing and digital modeling, is anticipated to further personalize treatment and improve clinical outcomes. Additionally, the rise of outpatient and ambulatory surgical centers is fueling demand for fixation systems that support rapid recovery and reduced hospital stays, aligning with broader healthcare cost-containment trends.

From an investment perspective, the sector is attracting significant interest from both strategic acquirers and venture capital. Major medical device companies are actively pursuing acquisitions and partnerships to expand their soft tissue fixation portfolios and leverage synergies in R&D and distribution. For instance, recent deals and pipeline investments by industry leaders such as Smith+Nephew, Johnson & Johnson MedTech, and Stryker underscore the competitive intensity and growth potential in this space. According to Fortune Business Insights, the global soft tissue fixation market is projected to reach over $3.5 billion by 2027, with a compound annual growth rate (CAGR) exceeding 6%—a trajectory that is expected to persist through 2025 as new indications and geographies are tapped.

- Increased R&D in bioactive and regenerative fixation materials

- Expansion into emerging markets, particularly Asia-Pacific and Latin America

- Strategic collaborations between device manufacturers and digital health companies to enhance surgical planning and post-operative monitoring

In summary, 2025 will likely see soft tissue fixation systems manufacturing characterized by rapid innovation, diversified clinical applications, and sustained investment momentum, positioning the sector for continued expansion and value creation.

Challenges, Risks, and Strategic Opportunities in Soft Tissue Fixation Systems Manufacturing

The manufacturing of soft tissue fixation systems in 2025 faces a complex landscape shaped by evolving clinical demands, regulatory scrutiny, and technological innovation. Key challenges include stringent regulatory requirements, supply chain vulnerabilities, and the need for continuous product innovation. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Commission have heightened oversight, particularly with the implementation of the EU Medical Device Regulation (MDR), which imposes more rigorous clinical evaluation and post-market surveillance. This has increased the time and cost associated with bringing new fixation systems to market.

Supply chain disruptions, exacerbated by global events and geopolitical tensions, present another significant risk. Manufacturers are increasingly exposed to shortages of critical raw materials such as medical-grade polymers and titanium, as well as delays in component delivery. According to McKinsey & Company, medical device companies are responding by diversifying suppliers and investing in digital supply chain management to enhance resilience.

Technological advancement is both a challenge and an opportunity. The rapid pace of innovation—such as the integration of bioresorbable materials, 3D printing, and minimally invasive delivery systems—requires substantial R&D investment. Companies that fail to keep pace risk obsolescence, while those that succeed can capture significant market share. For example, Smith+Nephew and Arthrex have expanded their portfolios with next-generation fixation devices, leveraging proprietary materials and design improvements to address unmet clinical needs.

Strategic opportunities lie in emerging markets, where rising healthcare expenditure and increasing rates of sports injuries and orthopedic procedures are driving demand. Localized manufacturing and partnerships with regional distributors can help global players navigate regulatory nuances and cost pressures. Furthermore, sustainability is becoming a differentiator, with manufacturers exploring eco-friendly materials and processes to align with hospital procurement policies and regulatory trends.

In summary, the 2025 landscape for soft tissue fixation systems manufacturing is defined by regulatory complexity, supply chain risk, and the imperative for innovation. Companies that proactively address these challenges—through compliance, operational agility, and technological leadership—are best positioned to capitalize on growth opportunities in both established and emerging markets.

Sources & References

- Fortune Business Insights

- Smith+Nephew

- Arthrex

- Medtronic

- Zimmer Biomet

- CONMED Corporation

- MarketsandMarkets

- Grand View Research

- American Academy of Orthopaedic Surgeons

- European Commission

- India Brand Equity Foundation

- World Health Organization

- McKinsey & Company